Find out which Payment Providers will save you money and convert more sales

COMPARE — Payment Gateways, Merchant Accounts and more.

TRUSTED BY 30K MERCHANTS GLOBALLY

I. Introduction

The UK payment systems regulator has released its annual report for 2023, providing updates on key highlights from the UK payments strategy, the implementation of the new payments system, open banking compliance, fraud prevention measures, digital identity verification solutions, cross-border payments, and international collaboration. In this article, we will examine each of these areas in detail and provide insights into the latest developments in the UK payment landscape.

II. Key Highlights from the UK Payments Strategy

The UK payments strategy has been a topic of discussion for several years now. In March 2021, the UK Payments Strategy was published as part of the government’s response to the pandemic. The document outlines the key highlights of the strategy, including the introduction of new payment systems and increased focus on digital transformation. One of the most significant changes outlined in the strategy is the implementation of the New Payments System (NPS). This system is designed to improve the speed and efficiency of payments processing in the UK. Additionally, the strategy emphasizes the importance of open banking compliance and fraud prevention measures. The document also discusses digital identity verification solutions and cross-border payments, highlighting the need for international collaboration in these areas. Overall, the UK Payments Strategy is a significant step towards modernizing the country’s payment infrastructure and ensuring that it remains competitive in the global marketplace.

III. Update on the New Payments System (NPS) Implementation

The UK government has made significant progress towards implementing its new payments system, known as the New Payments System (NPS). The NPS aims to modernize the country’s payment infrastructure and enhance the speed, security, and efficiency of payments processing.

To date, several key milestones have been achieved in the implementation of the NPS. These include the launch of a sandbox environment for testing new payment applications, the release of technical specifications for NPS-enabled devices, and the development of a comprehensive education and awareness campaign to inform stakeholders about the benefits of the new system.

In addition, the UK Payments Strategy has identified the need to address the growing threat of cybercrime in the financial sector. As part of this effort, the regulator is working closely with industry stakeholders to develop new fraud prevention measures and improve the resilience of the UK payment systems.

Overall, the implementation of the NPS represents a major milestone in the evolution of the UK’s payment infrastructure. By enhancing the speed, security, and efficiency of payments processing, the new system will enable businesses and individuals to conduct transactions more easily and securely than ever before.

IV. Focus on Open Banking 2.0 Compliance

Open Banking 2.0 compliance has become a crucial aspect of financial services in the UK since its introduction in 2018. The UK payments systems regulator, the Financial Conduct Authority (FCA), has been working closely with stakeholders to ensure that businesses comply with the regulations set out under this framework. In particular, the FCA has focused on improving customer outcomes through increased transparency, competition, and innovation in the sector. This includes measures such as requiring firms to provide clear and concise information about their products and services, ensuring that customers have control over their data, and promoting competition among providers. As the industry continues to evolve, the FCA will continue to monitor compliance with Open Banking 2.0 regulations to ensure that consumers remain protected.

V. Discussion on Fraud Prevention Measures in the UK

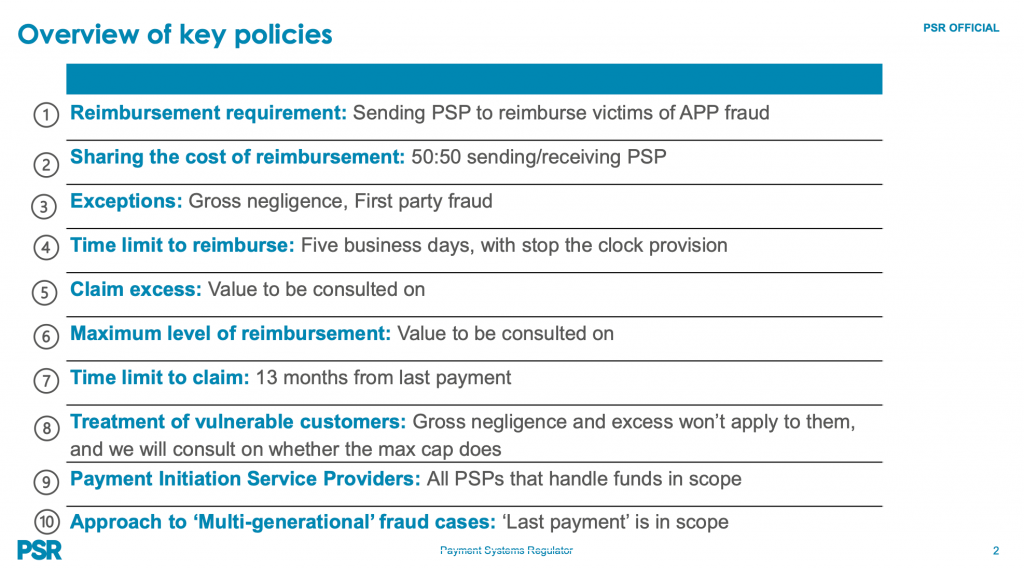

The UK payments industry has seen significant growth over the years, and with this growth, there have been increasing concerns around fraud prevention measures. The UK Payment Systems Regulator (PSR), which oversees the regulation of payment systems in the country, has taken several steps to address these concerns. One of the key areas of focus has been on improving authentication methods for customers making payments. This includes the implementation of biometric authentication such as facial recognition technology or voice recognition. Additionally, the PSR has introduced new rules requiring banks to verify the identity of their customers before allowing them to open accounts. These measures are aimed at reducing the risk of fraud and ensuring that customers can trust the security of their transactions. However, the regulator acknowledges that the fight against fraud is an ongoing challenge and that continued innovation and collaboration between industry stakeholders will be necessary to stay ahead of emerging threats. Overall, the PSR remains committed to working closely with industry players to ensure that the UK continues to have one of the most secure and reliable payment systems in the world.

VI. Examination of Digital Identity Verification Solutions

The UK payments industry has seen significant changes in recent years, with the introduction of new payment systems and regulations aimed at improving security and reducing fraud. One area that has received particular attention is digital identity verification solutions.

Digital identity verification solutions use advanced technology to verify the identity of individuals or businesses making transactions online or through mobile devices. This helps to prevent fraudulent activities such as identity theft, money laundering, and cybercrime.

The UK Payments Systems Regulator has been working closely with industry stakeholders to develop and implement digital identity verification solutions that meet regulatory requirements and provide greater protection for consumers and businesses.

One example of a digital identity verification solution is biometric authentication, which uses unique physical characteristics such as fingerprints, facial recognition, or voice recognition to confirm the identity of individuals. Another solution is multi-factor authentication, which requires users to provide additional evidence of their identity beyond a simple username and password.

In addition to these solutions, the UK Payments Systems Regulator is also exploring the use of artificial intelligence and machine learning algorithms to improve the accuracy and speed of digital identity verification processes.

As cross-border payments and international collaboration continue to grow, digital identity verification solutions will become increasingly important for ensuring the security of financial transactions. The UK Payments Systems Regulator will continue to work with industry stakeholders to ensure that digital identity verification solutions meet the highest standards of security and compliance.

VII. Outlook on Cross-Border Payments and International Collaboration

The UK payments industry has been at the forefront of innovation in cross-border payments and international collaboration. The UK Payments Strategy 2021-2025 emphasizes the importance of facilitating seamless and efficient cross-border payments, particularly in light of Brexit. The strategy aims to enhance the UK’s position as a global leader in fintech and digital payments by leveraging its strengths in open data, innovative technologies, and regulatory expertise.

One key area of focus is the development of new payment methods such as real-time gross settlement (RTGS), which can facilitate faster and more secure cross-border payments. Additionally, the UK is exploring the use of distributed ledger technology (DLT) to streamline international payments and reduce the risk of fraud.

Looking ahead, the UK will continue to collaborate with international partners to ensure a smooth transition after Brexit. The UK Payments Strategy recognizes the need for continued dialogue with European Union counterparts to ensure continuity of payments services across borders. Overall, the outlook for cross-border payments and international collaboration in the UK remains positive, with opportunities for growth and innovation in the years to come.

VIII. Conclusion

In conclusion, the UK payment systems regulator has made significant strides towards ensuring a secure and efficient payments ecosystem in the country. The implementation of the NPS, compliance with Open Banking 2.0, fraud prevention measures, digital identity verification solutions, cross-border payments, and international collaboration are all important areas that require attention. As we move forward into 2023, it is essential to continue to prioritize these areas to ensure a safe and reliable payments environment for all consumers and businesses in the UK.

In conclusion, the UK payment systems regulator has made significant strides towards ensuring a secure and efficient payments ecosystem in the country. The implementation of the NPS, compliance with Open Banking 2.0, fraud prevention measures, digital identity verification solutions, cross-border payments, and international collaboration are all important areas that require attention. As we move forward into 2023, it is essential to continue to prioritize these areas to ensure a safe and reliable payments environment for all consumers and businesses in the UK.